Are you an employer?

If you own a business as a sole proprietor, a partnership, or LLC, and you have employees, you are required to withhold income tax, social security, and Medicare.

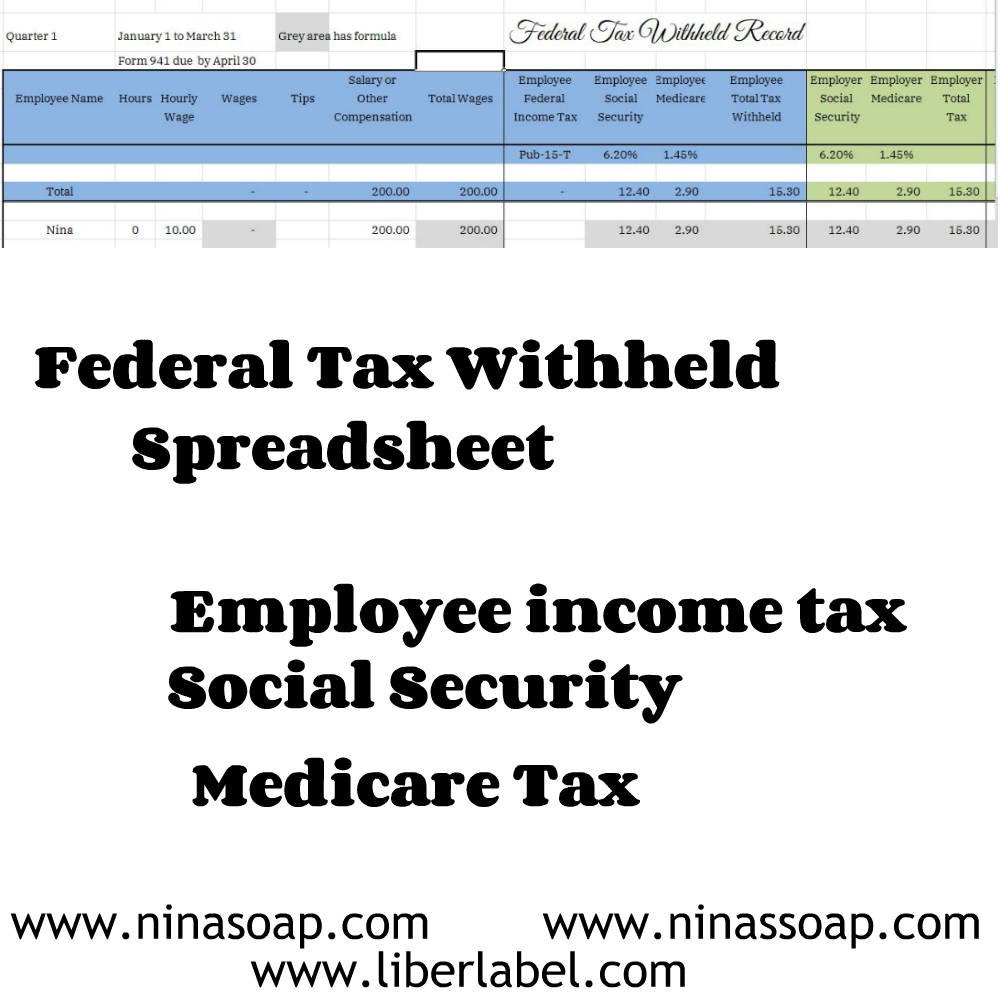

If you are a corporation or an LLC taxed as S corporation, and you work regularly in your business, you are your first employee. Whether you hire any other employee or not, you are required to collect income tax, Social Security, and Medicare tax on yourself. If you are a startup and don’t have an accounting or tax software that would do the calculation for you, you could do it yourself using a spreadsheet. Below is a spreadsheet template of Federal Tax Withheld Calculation.